By Tom Bradley, Executive Vice President, Energy Real Estate Solutions | (303) 386-7210 | tom.bradley@energyreco.com

Real estate development in the shale play markets can bring some of the highest returns in North America. Each market is unique but all lack the necessary infrastructure to sustain the lightning fast growth that has taken place across the last 5 years. With instability in oil prices, now is a great time to look for real estate opportunities in these markets… but what are they?

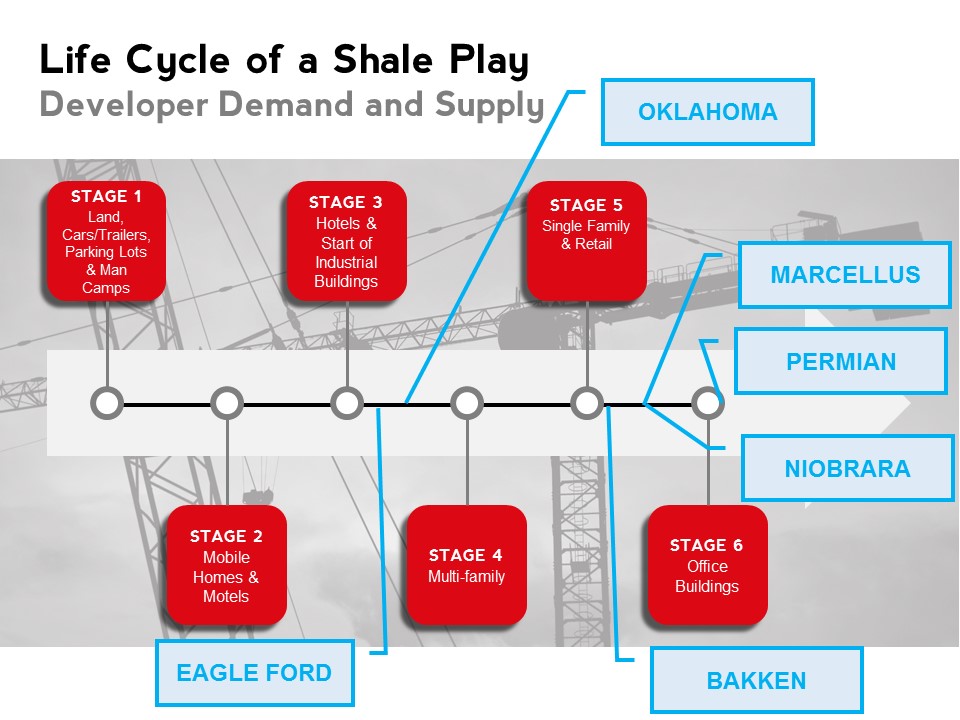

As many of these locations have evolved over the past several years we have seen common trends in the real estate development cycle that may prove to be excellent indicators of where investment and development opportunities lie. The following analysis highlights where each major shale play falls within the development lifecycle and shares some perspective on the impact of the oil price decline within each market.

Permian Basin

Stage 6 – Office Buildings

The Permian Basin can trace its roots back to 1925, when the first well was drilled there. Reports estimate that the Permian holds approximately 29% of estimated future oil reserve growth in the U.S. Midland/Odessa serves as the largest city in the play and has been at the center of oil and gas activity for decades. This longstanding oil and gas activity has allowed Midland/Odessa to be more prepared for the boom earlier this decade. With over four million square feet of commercial office space in the central business district alone, Midland is unlike any other shale play hub in the US.

Oil Price Impact?

Due to declining oil prices and other related factors, the rig count is down 52% from this time last year. This will impact demand across all product types and has already marked a steady decline in commercial lease rates. According to the Real Estate Center at Texas A&M February yielded the fewest homes sold in the area since early 2010. While home sales are at a five year low, commercial real estate continues to see very little vacancy regardless of the product. In terms of new development, those finalizing new hotels and multi or single family housing projects may wish for better timing, however there is still enough demand to drive success.

The hardest hit communities will be the smaller surrounding towns that have spent money to attract businesses (i.e. hotels, hospital improvements, truck stops, etc.) For example, Sweetwater, TX was attempting to position itself as a hub of the Cline Shale, but unfortunately smaller, less established towns within the major shale plays were the first to see rigs go.

Eagle Ford

Stage 3 – Hotels/Industrial Development

The Eagle Ford sprawls across south Texas from the border at Laredo to north of Austin. It was first developed as a natural gas play around 2008. In 2011, the Eagle Ford emerged as the highest in capital spending among all U.S. shale plays. In mid-2014, the Eagle Ford’s output rose to 1.4 million barrels per day, ahead of the Bakken and second only to the Permian Basin.

The Eagle Ford has had a multi-billion dollar impact on the local South Texas economy and quickly created over 100,000 jobs within the 20 county area impacted by the play. Similar to the Bakken the Eagle Ford is responsible for building cities. With little to no infrastructure available when this market boomed earlier this decade, housing inventory was a significant problem. Man camps began to pop up and were quickly filled to capacity. Today there is little to no vacancy with most commercial real estate products and numerous opportunities available to capitalize on this undersaturated market.

Oil Price Impact?

The rig count is down 43% in the Eagle Ford from this time last year. However, from a commercial real estate perspective there is little no vacancy. As the demand for more pipeline construction continues (an estimated $135 billion of future projects) the Eagle Ford market in particular will benefit providing another catalyst to drive high activity within the commercial real estate market.

Bakken

Stage 5 – Retail

Spanning North Dakota, Montana, Saskatchewan and Manitoba, the Bakken Shale Formation has approximately 9,000 wells (and counting) with estimates prior to the recent dramatic shift in oil prices highlighting potential growth to 50,000 to 150,000 wells. With key areas in the Bakken projecting some of the most significant population growth estimates in the U.S. and Canada, the highest industrial, retail, office, and residential rates in the U.S., and some of the lowest unemployment and vacancy rates, a need for increased infrastructure and support will be key to supporting the future development of this rural energy market. Development of multi-family has been significant in the Bakken and the retail sector is now starting to take shape. With multiple $100 million retail/mutli-use projects underway, the Bakken has gone through each phase of the shale play life cycle faster than any othermarket. With a four story, class A office building in Watford City currently under development, the Bakken is quickly making its way to stage six.

Oil Price Impact?

There is no question that the oil price decline has impacted the pace of development in the Bakken. However, the Bakken continues to be a very strong market with housing rates still in the range of $1,000-$1,500 per bed and industrial lease rates in the $20 NNN range. That said, raw land has been hit fairly hard. Developers are not keen on horizontal development at the moment as capital becomes harder to secure.

Niobrara

Stage 5.5 – Between Retail and Office

The Niobrara shale formation is primarily situated in northeastern Colorado but spans into parts of adjacent Wyoming, Nebraska and Kansas. Since 2009, oil production in Colorado has risen over 46%.

Productivity in and around the Niobrara shale formation is in its early stages but business is booming. Infrastructure challenges and shortfalls in the Niobrara’s most active drilling zones are not as significant as in other shale plays due to its close proximity to a major metropolitan area (Denver). However, companies are quickly buying land for future drilling activity and the development of additional supporting infrastructure.

The Niobrara has been compared by some to the Bakken shale formation farther to the north. However, since drilling and logistics in the Niobrara are far less expensive than the Bakken, the Niobrara is often seen as a “land of opportunity”, particularly during unstable economic times in the energy industry. The Weld County market in particular has seen an enormous amount of development over the last 5 years directly linked to oil and gas activity. Many big fast food chains, retail stores and car dealerships have found new homes in the Greeley area including Chick-Fil-A and Panera. This has truly revitalized the area. In addition, Noble Energy completed a 75,000 square foot office expansion and multi-family and single family developments continue to thrive.

Oil Price Impact?

Interestingly, the Northern Colorado market continues to be very strong and has not yet felt a major impact from a real estate perspective. Time will tell, but with a high quality of life and a more diversified economy than other shale plays, the impact of the decline in oil prices decline should be tempered. Currently, speculative developments are not quite as common in this market from an industrial and office perspective. However, as oil prices stabilize we suspect more developers will be willing to test this very strong market. Thus, the market has not been overbuilt and vacancy rates remain low.

STACK, SCOOP, Mississippian, Cana Woodford – Oklahoma

Between Stage 3 & 4 – Hotels & Multifamily

As a state, Oklahoma sits behind only Texas in the number of active rigs. With so many different shale plays, the activity is dispersed across the entire state. From a real estate perspective, this makes assessing the available opportunity challengingTowns like Purcell, Cushing and El Reno have all experienced sky rocketing property values, particularly Cushing, often considered the hub for oil storage and trading, and El Reno, the center of Canadian County (Cana Woodford) where 30%+ of active rigs in Oklahoma operate today. Because these markets are in close proximity to a larger metropolitan market like Oklahoma City/Tulsa, the development of new mutli-family, retail and office will be limited.

Oil Price Impact?

From an industrial perspective lease rates never jumped through the roof like the Bakken or South Texas. Vacancy rates have remained steady around 9% and rates for flex industrial space sit in the $6-$9 per square foot range. As drilling activity picked up across the last few years, many users were able to retro-fit existing industrial space reducing the need for speculative development and new builds. From a high level, real estate development will be steady and will continue to improve as oil prices rise and stabilize.

Marcellus

Stage 5.5 – Between Retail and Office

The Marcellus Shale is the 2nd largest pure gas play in the world spanning Pennsylvania, Ohio, West Virginia, New York and Maryland. Much of the drilling activity sits in Pennsylvania and West Virginia. Because the Marcellus is a gas play, it has not seen the dramatic decrease in rig activity like many oil plays and is currently down only 20% from this time last year. With much of the activity taking place so close to the Pittsburgh metropolitan area, a nice economic windfall has been created for the steel city. The Southpointe Business Park in Washington County has been a very successful office development that sees very little vacancy and is filled mostly with energy-related companies. There has not been quite as much speculative building in this market due to a number of factors including (but not limited to) a more challenging topography, low natural gas prices and political tension. In summary, this is a very strong market and has seen commercial development amongst all real estate products.